The Investment Thesis

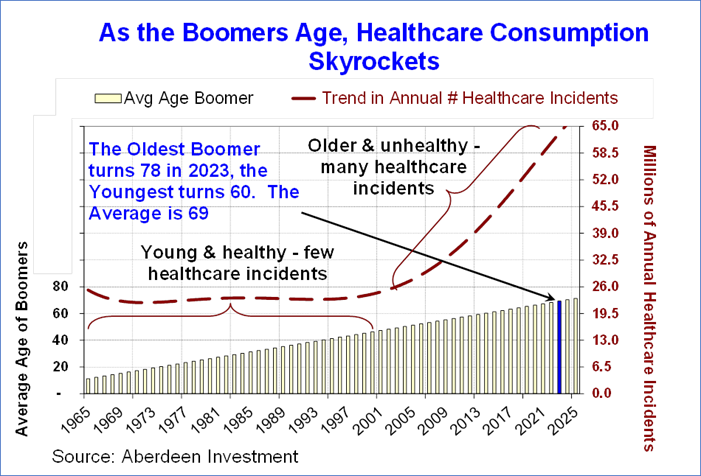

Exploding Need for Productivity in Healthcare

The aging of the Baby Boomers has resulted in an explosion in the number of healthcare incidents. Technology has to play a key role in effecting a dramatic increase in healthcare productivity.

There is a shortage of doctors, nurses, therapists, and support staff to provide healthcare services. There is a projected shortage of as high as 120,000 physicians in the U.S. by 2030. The practice of medicine has to change

Climbing the “S”

Aberdeen believes that many small medical technology companies are following normal technology adoption patterns. We are confident that the “best is yet to come” in terms of the revenue growth and value creation as the businesses leave the “chasm”. Revenues will ramp when technology is “sold” to the mainstream customer. All of the companies in the NexTech Medical portfolio are considered to be “across the chasm”. This is reflected in the weighted average revenue growth rate above 20%.

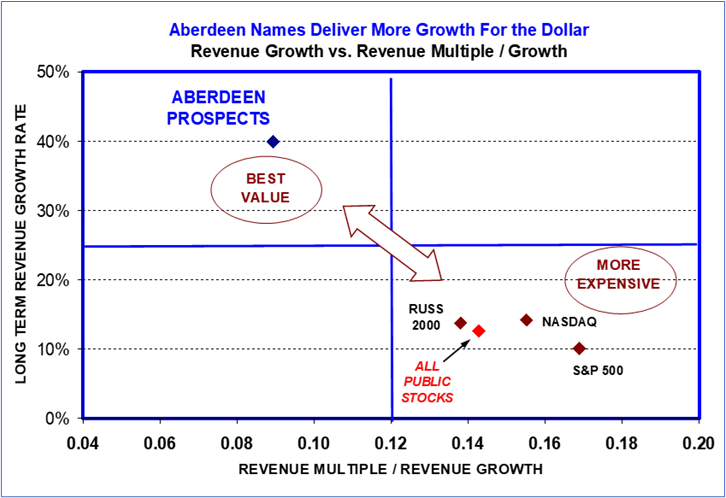

Microcap = More Growth, Better Value and Bigger Returns

Microcap technology companies, such as those comprising Aberdeen’s NexTech Medical portfolio, generate more growth than larger companies. Medical technology stocks with less than $1 billion in market capitalization tend to have median revenue growth that is over 2X greater than the S&P 500. They also tend to be cheaper than S&P 500 stocks in terms of the revenue multiple paid per point of revenue growth.

The above illustration may not accurately reflect present market conditions nor can it be assumed to represent all future market conditions

Valuation Upside Formula – Growth and Multiple Expansion

Aberdeen searches for companies capable of achieving the scale and valuation similar to more mature medtech stocks in the market today. We target medtech companies capable of sustainable top line growth in the area of 25% per year. This level of growth implies a 3X growth in revenue in five years. Companies of $300 million in revenue or more with this kind of growth command revenue multiples of as much as 3.5 to 5.0X.

Our job is to find companies that can be purchased for 2X +/- revenue today that can trade for 3.5X to 5X revenue in five years. Our downside should be the core revenue growth and our upside should be the expanded valuation multiple. In the example below, the stock of $8.00 would grow to $42.72 in 5 years assuming 25% annual revenue growth.

The above illustration may not accurately reflect present market conditions nor can it be assumed to represent all future market conditions.